Why specialized recruitment agencies are becoming even more important in the life sciences and chemical industries in the age of automated recruiting

When 80% of biotech, pharma and chemical firms report talent shortages, automation alone is not enough

In a recent case, a major global employer reported that approximately 87 % of companies now use AI in their recruitment processes, with 67 % of hiring leaders citing significant time savings from these technologies, a clear indicator of how deeply automation has penetrated modern talent acquisition workflows, according to IBM Global AI Adoption Index.

Internal HR teams across sectors are now equipped with AI driven sourcing platforms, automated screening systems, predictive analytics and structured workflows that dramatically improve efficiency enabling CV parsing in seconds, talent pools mapped almost instantly, and interview processes increasingly streamlined. For example, a leading industry dataset shows that AI adoption in recruitment has accelerated hiring efficiency and allows HR teams to reallocate time from routine screening to higher-value tasks, according to Gartner HR Technology Research.

Yet, across biotechnology, pharmaceutical and chemical industries, organizations that operate at the highest scientific and regulatory standards continue to rely on specialised recruitment agncies for their most critical roles, reflecting structural dynamics of these talent markets that technology alone does not solve. A recent talent outlook indicates that up to 80 % of biotech firms struggle to fill key positions in R&D, manufacturing and regulatory affairs, underlined by ManpowerGroup Global Talent Shortage Survey. Further, surveys in life sciences show that 45 % of employers report increased difficulty filling roles year-over-year due to skills shortages, and this challenge is among the top concerns for 2025 hiring strategies, according to SHRM Workforce Research.

In biotech and pharmaceutical recruiting, hiring extends far beyond a transactional exchange. Each recruitment decision can influence regulatory approvals, manufacturing continuity, clinical program execution and long-term company valuation, particularly in highly regulated environments where a delayed hire can translate into delayed product timelines or compliance risk, realities that push organizations toward expert recruiters with deep networks and domain knowledge.

Long-cycle expertise and market scarcity in life sciences

The challenge in biotech, pharmaceutical and chemical recruitment is not an absence of applications, but an acute shortage of qualified professionals whose expertise cannot be easily substituted or scaled. Across life sciences and chemistry sectors, the competition for specialist talent continues to intensify because unemployment rates for scientific and technical roles remain extremely low, often below 2 %, creating a market where demand far outstrips supply. This dynamic makes the industry one of the most candidate-scarce markets globally, where merely increasing volume does not resolve the qualification gap, according to Korn Ferry Global Talent Crunch.

Unlike industries where skills transfer more fluidly, life sciences and chemistry roles require highly specialized knowledge and experience that is rarely generic. Positions such as senior Regulatory Affairs leaders, CMC (chemistry, manufacturing and controls) experts, Qualified Persons (QPs) responsible for GMP certification, Clinical Operations Directors, and Analytical Development Specialists demand domain expertise built over many years of progressive responsibility. These professionals must deal with complex regulatory ecosystems, manage inspections and audits, drive clinical trial execution, and ensure compliance with stringent frameworks, competencies that cannot be rapidly taught or automated.

Because these skill sets are gained through long-term exposure to scientific, regulatory and operational pressures, candidates for such roles remain highly selective in their career decisions. Many are already embedded in demanding positions and do not respond to broad outreach or standard automated alerts. Their moves are influenced by thoughtful alignment, stability, scientific mission, and leadership credibility more than by process-driven hiring campaigns. This situation aligns with broader industry insights showing that life sciences companies are inundated with applications but continue to report significant difficulty sourcing qualified candidates for critical functions.

This structural scarcity explains why traditional recruitment channels often fall short: the constraint is not simple outreach volume but access to verified expertise, credible evaluation of nuanced experience, and deep contextual understanding of the roles being filled. In this environment, having a credible industry network, domain-specific assessment methods and seasoned talent advisers is essential to identify and engage the rare professionals whose capability directly impacts regulatory success, product timelines and long-term organizational outcomes.

The expanding mandate of internal HR in life sciences and chemical organizations

Internal HR teams play a central strategic role in life sciences organizations. According to Deloitte Global Human Capital Trends and PWC Workforce Strategy Surveys, HR functions are increasingly responsible for enterprise-wide transformation initiatives, workforce planning, compliance governance, diversity strategy, leadership development and digital workforce enablement, far beyond traditional recruitment administration. In regulated industries such as biotech, pharmaceuticals and chemicals, this scope is even broader due to stringent compliance obligations and inspection readiness requirements.

In practice, recruitment represents only one component of HR’s mandate. HR leaders simultaneously oversee employee relations, performance management systems, retention frameworks, succession planning, compensation architecture and regulatory compliance programs. In highly regulated environments, HR also plays a role in ensuring alignment with good manufacturing practice (GMP) expectations, documentation standards and audit preparedness, responsibilities that demand continuous operational focus.

At the same time, industry reports consistently highlight that life sciences and chemical companies face persistent shortages in specialized roles, particularly in Regulatory Affairs, Quality Leadership, Advanced Manufacturing and R&D.

When a senior Regulatory director, a Qualified Person, or a CMC leader must be hired, the search often requires:

- global talent mapping

- detailed assessment of submission history

- inspection exposure, and engagement with passive candidates who are not actively seeking new roles

McKinsey has reported that time-to-fill for highly specialized scientific leadership roles can exceed 90 days, particularly when the talent pool is internationally constrained and regulatory experience is required. Sustaining this level of focus internally for several months can create bandwidth pressures, not due to lack of competence, but due to competing strategic priorities across HR’s expanding mandate.

AI adoption is rising but judgment remains the differentiator in biotech, pharma, and chemical industry

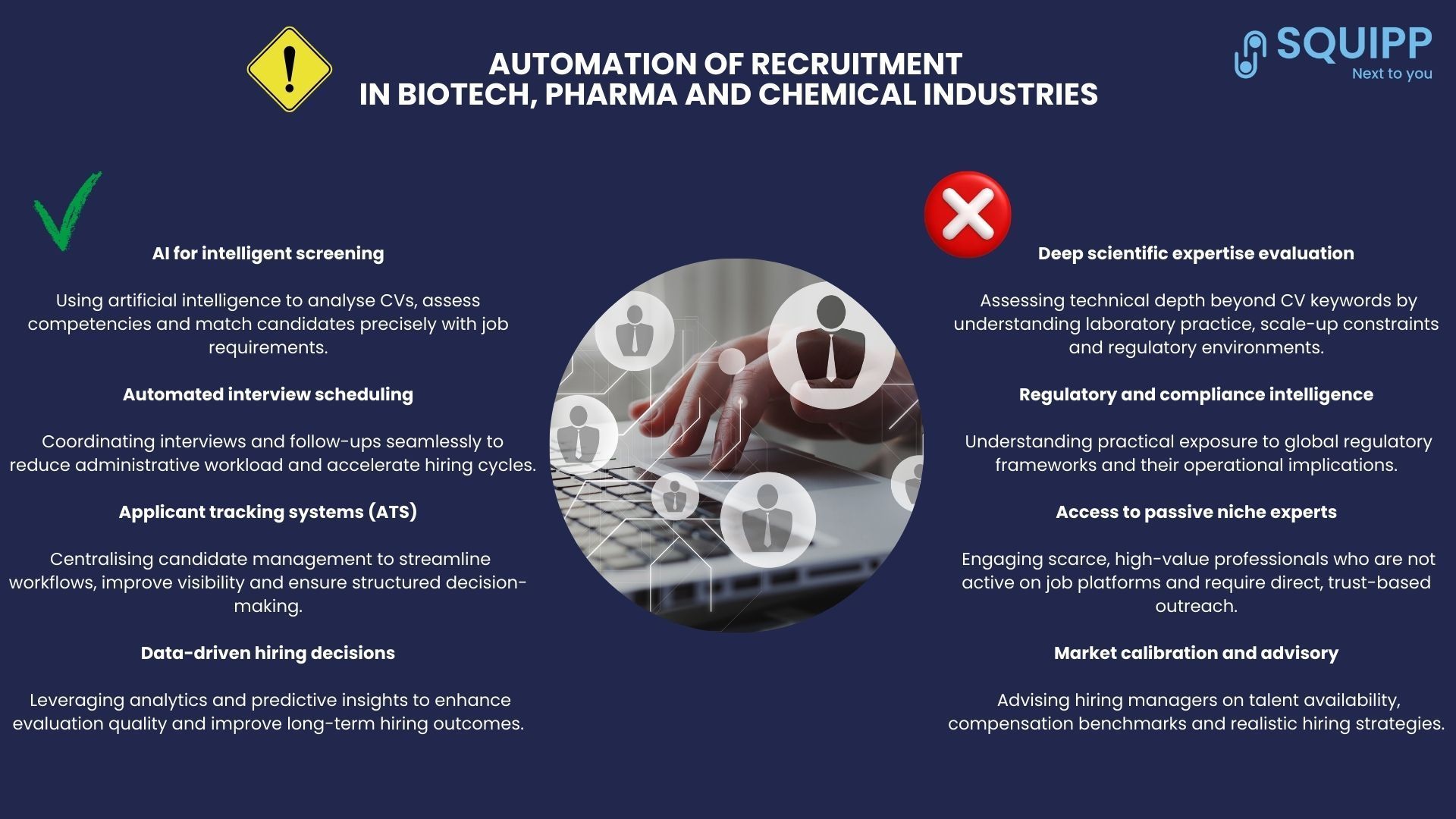

While AI tools bring measurable operational gains, they cannot fully address the complexity of life sciences, pharmaceutical, and chemical recruitment. Automated systems excel at parsing CVs, screening candidates, and tracking pipelines, but they fall short when evaluating the critical qualitative aspects of specialized roles.

For example:

- Regulatory ownership and accountability: AI can recognize titles such as “CMC Manager” or “Regulatory Director,” but it cannot distinguish if a candidate directly led submissions, managed inspections, or was involved only in supporting documentation. These differences are important in regulated environments, where ownership determines regulatory risk exposure.

- Inspection and audit experience: Participation in FDA or EMA inspections looks similar on paper to actual leadership during inspection defense. Only a recruiter with domain expertise can interpret the significance of inspection-tested leadership for compliance and operational continuity.

- Strategic impact in clinical, manufacturing, and quality roles: AI cannot assess how a professional’s decisions affected trial outcomes, product timelines, or manufacturing scale-up. Two candidates with identical job histories may vary significantly in their real-world contribution to regulatory success and operational performance.

- Contextual understanding of scientific and technical expertise: AI lacks the ability to interpret how candidates navigated complex scientific challenges, advanced therapy regulatory pathways, or accelerated approval mechanisms. In specialized sectors, these distinctions directly influence compliance, product quality, and patient safety.

Furthermore, many senior life sciences professionals are passive candidates. According to LinkedIn Economic Graph, executives in regulatory, CMC, or quality leadership roles rarely respond to standard job applications or automated outreach. Their career moves are guided by factors such as pipeline maturity, organizational stability, scientific mission, and leadership credibility, rather than process-driven hiring campaigns. AI cannot replicate the personalized engagement required to access these highly sought-after professionals.

Even in high-volume recruitment environments, AI is unable to evaluate nonlinear indicators of candidate maturity, such as regulatory decision-making history, cross-site manufacturing oversight, or clinical trial ownership. Misinterpretation of these factors can lead to operational delays, regulatory setbacks, and significant financial consequences. Development delays in pharmaceuticals can cost between $600,000 and $8 million per day depending on the asset stage.

AI enhances efficiency by reducing administrative workload, improving compliance tracking, and structuring candidate pipelines, it cannot replace the judgment, domain knowledge, and contextual evaluation that specialized recruitment expertise provides. In life sciences and chemical sectors, recruiting the right senior talent requires a combination of AI-enabled efficiency and human-led strategic insight, making specialized recruitment partners indispensable.

The future of life sciences hiring, a modern collaborative recruitment model in a rapidly expanding scientific ecosystem

The life sciences and chemical industry is not only talent constrained, it is structurally expanding in complexity. According to Evaluate Pharma and IQVIA Global Outlook Reports, pharmaceutical R&D spending has continued to grow year over year, exceeding $200 billion globally, while the number of active clinical trials worldwide has surpassed 450,000 registered studies. At the same time, regulatory agencies such as the FDA and EMA have reported increasing submission volumes, particularly in biologics, advanced therapies and complex combination products.

This expansion creates cumulative pressure across regulatory, clinical and manufacturing functions. The rise of highly specialized biologics and advanced manufacturing platforms has increased technical demands on CMC, quality and regulatory leadership. FDA data shows that biologics license applications and complex product submissions have grown substantially over the past decade, requiring deeper scientific and compliance expertise.

In parallel, global supply chains have become more distributed. Biotech, pharmaceutical and chemical companies increasingly rely on multi-site manufacturing networks and CDMO partnerships. According to industry manufacturing outlook, this globalization increases oversight complexity, inspection exposure and cross-functional coordination requirements. These macro trends reshape recruitment priorities.

Internal HR functions must manage workforce planning across expanding pipelines. AI tools help structure recruitment processes and manage growing candidate datasets. But the increasing scientific sophistication of products and regulatory frameworks demands contextual interpretation that goes beyond automation.

A collaborative recruitment model becomes essential not simply because talent is scarce, but because the industry itself is becoming more technically layered and operationally interdependent. Specialized recruitment expertise contributes industry fluency in areas where precision matters most:

- Distinguishing experience in small molecule versus biologics manufacturing

- Understanding exposure to advanced therapy regulatory pathways

- Interpreting submission ownership under accelerated approval mechanisms

- Evaluating inspection-tested leadership in multi-site environments

As regulatory submissions grow in complexity and manufacturing ecosystems expand globally, hiring errors compound in impact. Organizations that integrate internal HR governance, AI-enabled process infrastructure and specialized recruitment agencies expertise are better positioned to secure high-impact leadership capable of navigating scientific expansion, regulatory intensity and operational scale.

The industry will continue to grow, advanced therapies will expand, regulatory frameworks will evolve, inspection standards will tighten. Technology will support recruitment processes, but it will not replace domain expertise. In life sciences and the chemical industry, targeted expertise in hiring determines long-term compliance, product quality, and ultimately patient safety.

Partnering with specialized recruitment agencies ensures that companies can access the rare, highly qualified professionals whose expertise directly impacts regulatory success, manufacturing continuity, and clinical outcomes, providing an important advantage in a highly competitive and regulated market.

Frequently Asked Questions (FAQ)

Q1: Why is AI not enough for recruiting in life sciences, pharma, and chemical industries?

AI can streamline candidate sourcing, CV parsing, and workflow automation, but it cannot evaluate critical qualitative aspects such as regulatory ownership, inspection experience, strategic decision-making, or contextual scientific expertise. Senior professionals are often passive candidates, requiring human-led engagement to assess real-world impact and credibility (IBM Global AI Adoption Index,

LinkedIn Economic Graph,

McKinsey Life Sciences Insights).

Q2: What makes life sciences and chemical recruitment different from other industries?

These sectors involve highly specialized roles where candidates’ expertise directly affects regulatory approvals, manufacturing continuity, clinical trial execution, and long-term company valuation. Unemployment rates for scientific and technical roles are often below 2%, making it a highly competitive and candidate-scarce market (Korn Ferry Global Talent Crunch).

Q3: What roles are hardest to fill in these industries?

Roles such as senior Regulatory Affairs leaders, CMC experts, Qualified Persons (QPs) responsible for GMP certification, Clinical Operations Directors, Analytical Development Specialists, and Quality Leadership positions are particularly difficult to fill due to the deep domain expertise required (ManpowerGroup Global Talent Shortage Survey,

SHRM Workforce Research).

Q4: How long does it take to hire specialized scientific leadership?

Time-to-fill for highly specialized roles can exceed 90 days, especially when regulatory experience is required and the talent pool is globally constrained. Internal HR bandwidth and competing priorities make these searches even more complex (McKinsey Life Sciences Insights).

Q5: How do specialized recruitment agencies add value?

They provide deep market knowledge, domain-specific assessment, and access to passive, highly qualified candidates. Agencies can differentiate between candidates with similar titles but vastly different experience in submission ownership, inspection readiness, or operational impact, reducing risk and protecting enterprise value (LinkedIn Economic Graph,

Korn Ferry Global Talent Crunch).

Q6: Can AI identify passive candidates and their true expertise?

No. AI excels at processing structured data but cannot interpret nuanced experience, regulatory ownership, or the candidate’s strategic impact. Human judgment is essential for assessing these critical factors (Gartner HR Technology Research,

McKinsey Life Sciences Insights).

Q7: Why is collaboration between internal HR and specialized recruitment agencies important?

Life sciences organizations are complex and regulated, with multi-site operations and increasing technical sophistication. Collaboration ensures recruitment decisions match both compliance requirements and operational strategy while leveraging AI for efficiency (Deloitte Global Human Capital Trends,

Evaluate Pharma,

IQVIA Global Outlook).

Q8: What are the risks of hiring misalignment in these sectors?

Misaligned hires can delay regulatory submissions, disrupt manufacturing scale-up, affect clinical trial progression, or create compliance vulnerabilities. Financial consequences can range from hundreds of thousands to millions of dollars per day depending on the project stage (McKinsey Life Sciences Insights).